Stocks, property value boom push U.S. wealth to record

Original Article Published by Axios Closer

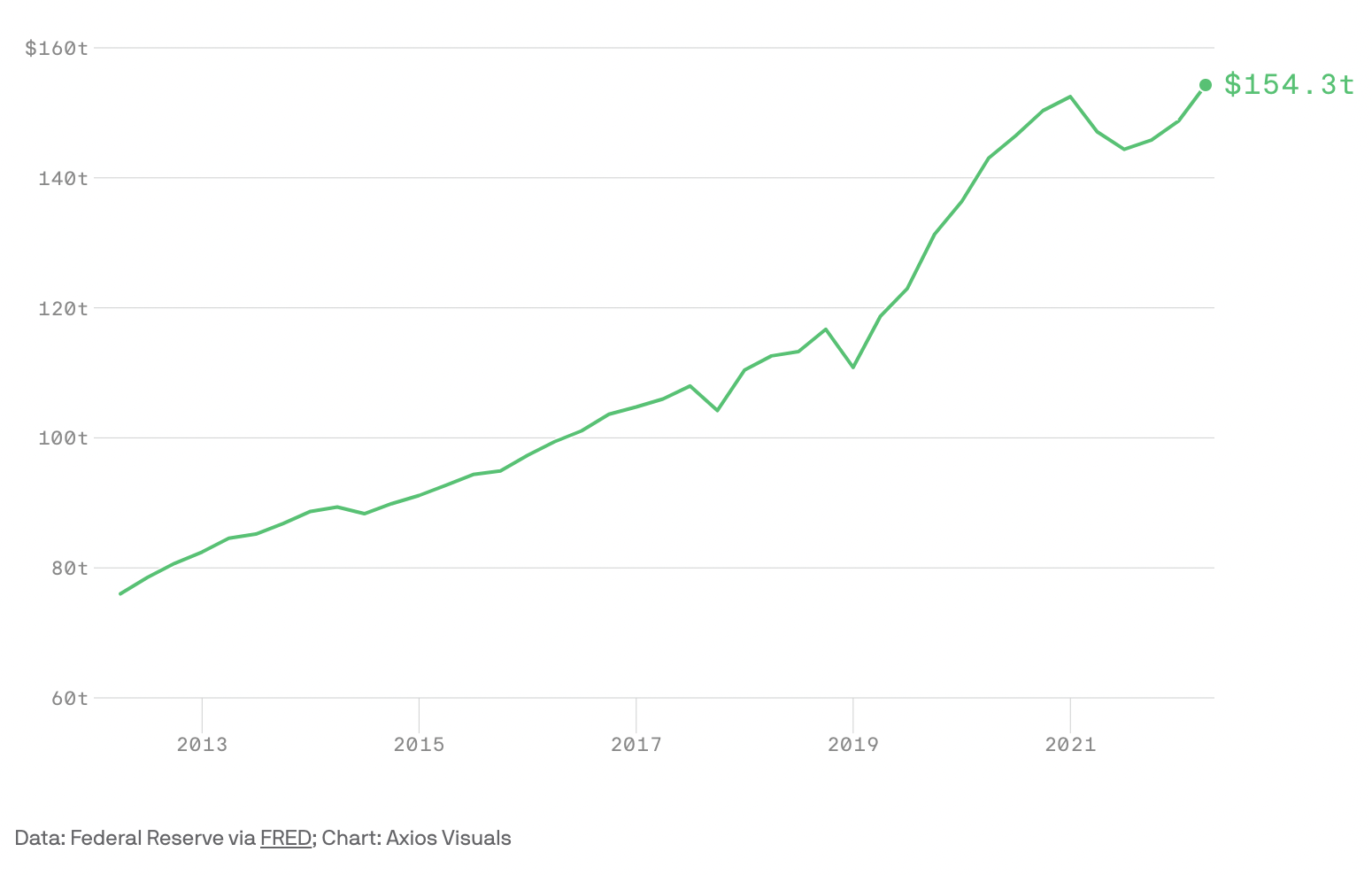

Property values and a strong stock market pushed U.S. household wealth to a record high of $154.28 trillion in the second quarter, Federal Reserve data published Friday showed.

Why it matters: The data solidifies the growing narrative that — at least for now — the U.S. economy is faring far better than its major counterparts (particularly Europe and China.)

It also underscores how the Fed's aggressive tightening offensive against inflation hasn't driven the economy into a ditch, or curbed voracious consumer demand.

Households have fully recouped losses suffered last year as the Fed's interest rate hikes took their toll on stocks and the housing market, Reuters notes.

Zoom in: Household net worth rose to $154.3 trillion, up from $148.79 trillion at the end of the first quarter.

A rally in stocks contributed $2.6 trillion in gains, or nearly half of the increase.

Rising property values contributed $2.5 trillion.

Compared to the first quarter of 2022, which set a previous record high of $152.49 trillion, household net worth is up by about 1.2% or $1.8 trillion.

The calculation is based on the balance sheets of households, businesses, federal, state and local governments.

The big picture: Analyst expectations for a recession continue to shrink, with Goldman Sachs earlier this week lowering its probability for a downturn within the next 12 months to 15% from 20%.

What to watch: Cash holdings are down for a record fifth straight quarter.

National debt levels for individuals, businesses and governments also continued to rise, driven by federal government debt.